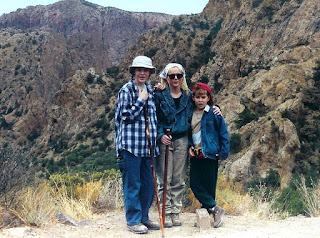

As "offline" as it gets. Me, my mom, and my brother at Big Bend National Park, circa 1999-ish?

I work in the tech industry, at a job that requires me to be plugged in and logged in every workday. So, when I plotted out this particular goal, my idea was never that I was going to move out into the mountains for a month and work on my novel in a cabin warmed by firewood (although if you'd like to fund such an endeavor, please feel free to leave a comment or wire money). From the start, my plan was to ban myself from the internet after I left work each weekday, and stay off of it on the weekends. I picked the month of June to try and tackle this feat, because now that I'm back to my team management gig, it's often tough to unplug at home.

At the start of this goal, the fear of missing out felt very strong. I swore off of Instagram altogether, and barely peeked at Facebook on breaks at work. I wondered at the life achievements I was missing my friends make, the cute baby and/or puppy photos that would go forever unseen. But after about a week of cutting myself off from constant social check-ins...I found I not only didn't miss it, but I was relieved by breaking free. There was nothing I felt like I had to compulsively keep up on, so I was allowed to just live my life out in the world.

My only book credit thus far lives in this here Rob Sheffield outfit.

Other than feeling less anxious about keeping up with everyone at all times, one of the greatest things I gained from this experiment was reading a whole lot more. I finished two books written by my latest authorial-obsession, Lauren Groff, and sometimes, as Zack was making dinner after I got home from work...I just sat. Yep, just sat on the couch quietly, doing nothing but breathing. This is very difficult for me to do, so by being able to simply sit, I found that I felt much more in control of myself. It was a comforting and refreshing feeling.

This has been a big part of my life over the last month.

In my free time after work (of which there seemed to be much more all of a sudden), I indulged in my new favorite things: reading Groff, listening to African Jazz vinyl, playing cards with my husband, and going to my boxing class. Occasionally, a friend or family member would ask if I'd seen the link they posted on my Facebook wall, and I'd have to shrug and say, "No, since it's Saturday I won't be checking again until Monday on a work break." And I discovered that this didn't kill me, and nobody disowned me for my disconnection.

I tried to keep my "rules" surrounding this goal loose so I wouldn't beat myself up for "failing." That's why I still allowed some social connection while I was at work, and why I didn't get upset with myself when, during the last week of the month, I had to go online in order to finish up some work (and went on some of my favorite blogs in the process). This has also instilled in me the freedom to institute this practice periodically from now on - one permanent change I made was to turn off notifications for most of my apps, so that my iPhone wasn't constantly forcing my next steps. I'll peek on Instagram at times, but it's less compulsory now. I feel somewhat freed from my electronics and accounts.

I've lost my footing a little in my newfound freedom, because in moving back to my old job I've had difficulty with balance. I'm hopeful, though, that I can return to this practice, or at least continue to be selective in how I spend my time (e.g. using my Calm app to practice meditation instead of Insta-stalking people I don't know). By disconnecting from the virtual reality of Teh Webz, I've been able to feel a lot more awake IRL, and it feels good.